Contrary to popular belief, very first time customers believe a giant down-payment needs purchasing a house. This is from the correct. You can expect a number of options that give lower to help you zero down payment lenders. You to definitely low down percentage choice is the fresh Freddie Mac computer Domestic You are able to financial. Perhaps you have heard of other low-down fee loan called HomeReady. HomeReady is out there by the Freddie Mac’s brother service Fannie mae. Freddie and you will Fannie exists to provide mortgage lenders the capacity to bring affordable investment for people and you may homeowners. Those two reasonable lending products are fantastic choices to participate that have FHA and also for particular instances, has actually pros over FHA.

Really know one home values, along with cost, were rising recently. A number of section, rising home values specifically create homeownership burdensome for basic-go out buyers to attain, however, Household You’ll be able to assists rookies come through that it barrier which have cost and flexible guidelines.

Domestic You can easily Financial Deposit

Rather than 20%, 10%, otherwise 5% down, consumers are able to lay out step 3%. Perhaps even less than 3% with more resource named reasonable moments. With a down payment of only step 3% performing like a reduced burden to entryway, there are so many getting the money. Several common an easy way to come up with the newest down-payment become:

- Tax reimburse Understand how to better use an income tax refund buying

- Borrow secured on a valuable asset

- Promoting a secured asset like an automible, four-wheeler, watercraft

- Borrow against a retirement account

- Present off household members or manager

- Payroll added bonus or percentage

- Conventional coupons

Its actually simple for the brand new deposit in the future out-of what exactly are called affordable seconds. Speaking of 2nd mortgages that will otherwise ount of those supplies, each enjoys particular borrower and property conditions. At the same time, an inexpensive 2nd need certainly to fulfill Freddie Mac’s unique requirements too. Oftentimes, we would manage to meets one to a down payment origin.

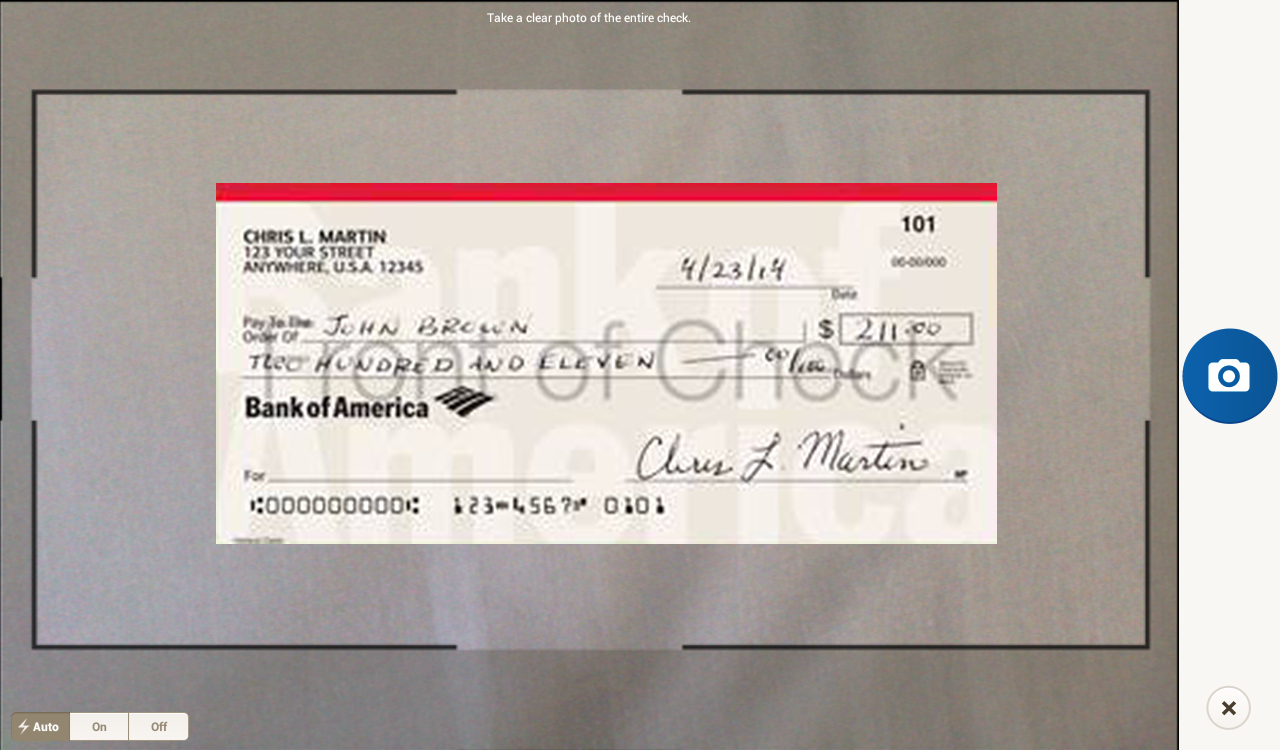

Which includes development or cost management, there are many ways that a purchaser can help to save in the loans because of it low-down payment. An agent may even use the commission into the purchase of their home since down-payment! A bottom line to keep in mind would be the fact lenders require papers of advance payment origin. So, cash is not allowed. Along with, in the event that using a resource eg significantly more than, get hold of your OVM Bank loan officer to make sure its documented correctly. It is advisable to make sure documentation is treated precisely upwards-front side because it is tough to get back and you can correct it.

Domestic Possible Guidelines

Both terms and conditions one ideal define this choice was flexible and you may reasonable. The newest underwriting recommendations offer opportunities for most customers so you’re able to be considered you to may well not be eligible for most other products. The our direction are:

- Just 640 lowest credit score

- $100,100000 lowest loan dimensions

Family You can easily Home loan Insurance policies

All the way down mortgage insurance policies may well not feel like a Saybrook Manor loans big deal, however it is. Here is the city and this reduces the loan percentage versus FHA or other conventional loan points. Just ‘s the financial insurance policies straight down, nonetheless it can certainly be terminated since the financing equilibrium falls below 80% of the appraised really worth. So, immediately after surviving in the home for enough time, new citizen might have a decrease from inside the houses commission into other countries in the loan identity. There are certain laws and regulations getting canceling PMI otherwise financial insurance rates. Here are a few a popular post, Whenever do PMI prevent towards the FHA, USDA, and you can antique money?

Family You can easily Earnings Constraints

Like other sensible mortgage products, Home You can has an optimum income limitation. As opposed to USDA or certain down payment direction facts, that it home loan doesn’t go by domestic money. Instead, new borrower’s yearly earnings must be equal to or lower than the bedroom average income towards census region where possessions is found. Unless! If for example the property is for the an excellent designated underserved urban area, then there’s zero money maximum! In addition, in the event your home is inside the an excellent designated high-cost area, the space median earnings restrict is actually high. These features help a number of people which make along side money restriction but still you desire an inexpensive loan.

Sample Section Having Domestic You can easily Zero Money Limitations

Part or each one of Shallotte NC, Wilmington NC, Sanford NC, Fayetteville NC, Southern area Pines NC, Charlotte NC, Jacksonville NC, Chesapeake Va, Norfolk Va, Myrtle Coastline South carolina, Charleston Sc, San Antonio Tx, Dallas Texas. Really towns features at the least a portion that qualifies for no earnings restrictions.

Lookup Domestic It is possible to Money & Assets Qualification Right here

Your loan officer commonly evaluate financing alternatives for both you and area of that includes explaining brand new PMI, advance payment, and official certification for the individuals mortgage affairs. For each customer’s qualification and you will needs vary, therefore speak to a keen OVM Financial loan officer today understand that works for you.